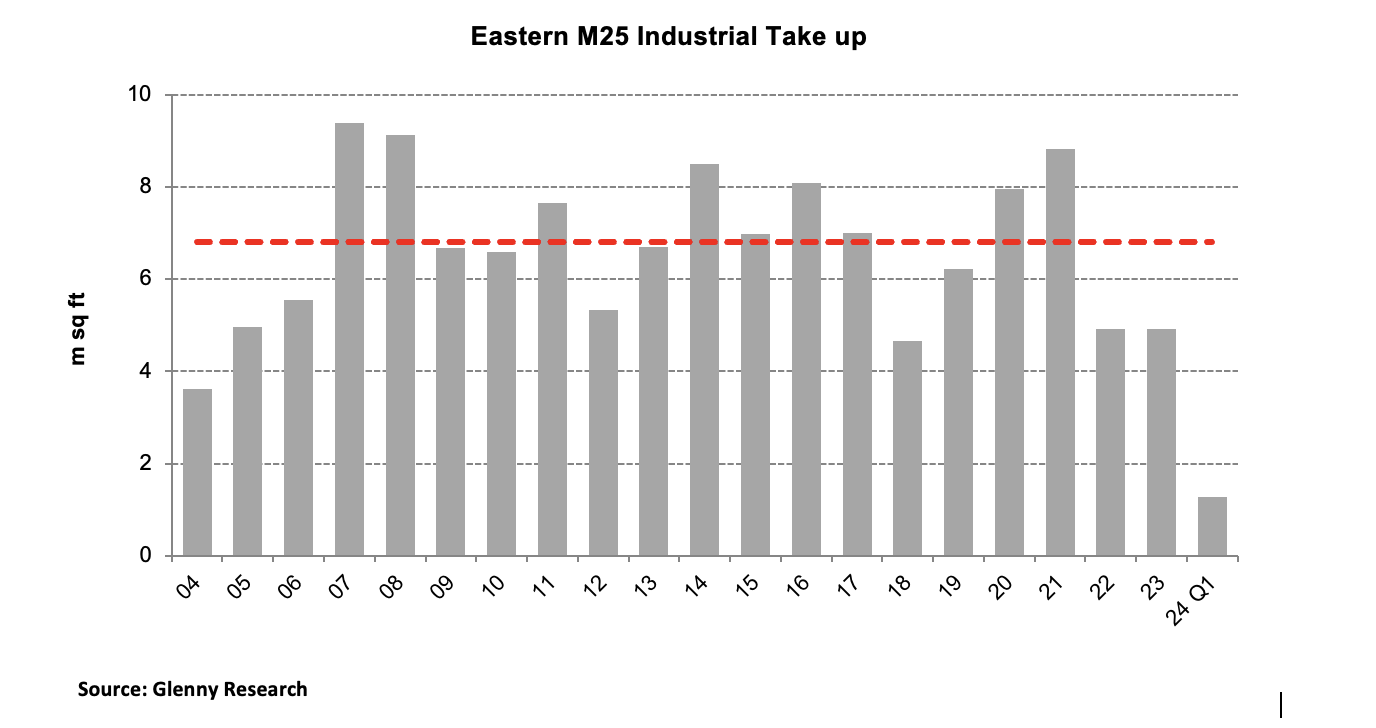

Glenny’s latest research into the Eastern M25 commercial property market confirms that industrial take up ‘flat lined’ in 2023, with total activity of just 4.9m sq ft having been recorded, the same level as the previous 12 months. The main brake on activity has been the slowing in the Big Box market, which saw take up fall to its lowest level in 10 years now standing at just under 1m sq ft in three transactions.

The current year has started on a more positive note, with the initial estimates of take up standing at 1.3m sq ft at Q1 2024 buoyed by the first Big Box deal of the year being secured at DP World’s, London Gateway, where multi modal logistics group Ziegler UK moved to a new 410,000 sq ft super hub facility. If the current trend continues throughout the remainder of the year, then activity could tip above 5m sq ft for the first time in three years.

John Bell, Head of Commercial Agency at Glenny commented, “The past two years have been a tricky period for the industrial sector, with activity slowing quite significantly following the post pandemic ‘boom’. Whilst the complexity of getting product to market and the disruption to supply chains has only intensified following the onset of conflicts in Ukraine and the Middle East, arguably the real barrier to activity at the moment is one of sentiment and poor economic confidence. Rents continue to reflect these challenges, and whilst prime values have edged to new highs in some locations across the Eastern M25, I’d suggest that the current period of consolidation is set to be with us for a while yet.”

To compound matters there has been an increase in the delivery of new space to the market over the past 12-18 months and as such, supply has moved to levels last seen in 2014, rising to 13.5m sq ft at the end of Q1 2024, with the proportion of grade A space at a new high of 5.5m sq ft. The majority of new stock has been in the Big Box sector, where 2.9m sq ft in 15 buildings is currently on the market.

Bell reflects, “Supply has certainly been boosted by the completion of a number of new schemes over the past 12-18 months and this has served to increase the supply of more energy efficient buildings which improves choice for incoming occupiers seeking to improve their ESG credentials. Invariably though, whether this is a good or bad thing for the market depends upon whether you’re buying or selling!”

The demand for space has eased back to 20.9m sq ft in the six months to the end of Q1 2024 but remains ahead of overall supply. The pattern of demand has changed significantly over this period, with Big Box requirements down to 8.5m sq ft and the demand for medium sized (10,000-50,000 sq ft) and Mid Box units up to 10.4m sq ft.

Bell concludes, “The next 12 months will remain challenging for the sector but occupiers have a much greater choice of new energy efficient buildings to enhance their operational capabilities going forward. The early signs are that activity will improve from the low point of the past two years and is expected to move back towards trend levels. Away from the Big Box “glamour” end of the market, activity for small to Mid Box product has remained relatively buoyant and the demand profile suggests that this will continue. Glenny monitor the whole market and our research indicates that more than 50% of market transactions are in buildings of less than 50,000 sq ft. In 2023 64% of all take up was in the sub 50,000 sq ft size bracket across the Glenny region.”

Offices

Office market take up fell to a 20 year low in 2023, with activity of 1.1m sq ft more than 50% below the 10 year average for the Eastern M25 region. All sub regions saw turnover slow but Docklands and the East London market were most severely impacted.

Recent trends in demand are indicating a renewed desire by employers to see a return to the office, with an upturn in requirements to 1.2m sq ft and an increase in the demand for buildings above 10,000 sq ft, which accounts for 65% of overall floor space demanded.

Supply, particularly of grade A space, remains tight, with only 1.5m sq ft of new or comprehensively refurbished space on the market across the region, with three quarters of this space in Docklands and East London. Overall supply has reduced in recent months, with a number of properties being withdrawn from the market pending repurposing.

Stay tuned for the release of our Q1 2024 Databook, coming soon.